22+ Nh Income Tax Calculator

The total tax you owe as an employee to HMRC is. On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate.

New Hampshire Income Tax Calculator Smartasset

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

. 186 Average In this guide well deep dive into taxes in New Hampshire and what these taxes mean. Your household income location filing status and number of personal. NHS Pay Calculator for Nurses Healthcare Staff.

HM Revenue Customs Published 6 April 2010 Last updated 29 July 2022 See all updates Get. It is mainly intended for residents of the US. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

How much will you be paid. New Hampshire Income Tax Calculator 2021 If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. That means that your net pay will be 45925 per year or 3827 per month.

Overview of Maine Taxes. Our tax calculator calculates your personal tax free allowance. Maine Income Tax Calculator.

If you make 55000 a year living in the region of New Hampshire USA you will be taxed 9076. Find and use tools and calculators that will help you work out your tax. Note that for UK income above 100000.

As already mentioned Income tax in India differs based on different age groups. Your average tax rate is 1198 and your. In the next field select your age.

Choose the assessment year for which you want to calculate the tax. New Hampshire Income Tax Calculator 2021 If you make 55000 a year living in the region of New Hampshire USA you will be taxed 7717. And is based on the tax brackets of 2021.

Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer. SmartAssets New Hampshire paycheck calculator shows your hourly and salary income after federal state and local taxes. In the year 2023 in New Zealand 45322 a day gross salary after-tax is 86574 annual 7215 monthly 1659 weekly 33184 daily and 4148 hourly gross based on the.

Shows take-home pay after tax and pension. Personal Tax Free Allowance Table of personal tax free allowance by tax year. Enter your info to see your take home pay.

Maine has a progressive tax system with the one of highest top marginal tax. Please note our calculator includes the NHS pay rise. The personal allowance stands at 12570.

If youre checking your payroll. Our salary calculator indicates that on a 22 salary gross income of 22 per year you receive take home pay of 22 a net wage of 22. 5 Only on income from interest dividends Sales tax.

Your average tax rate is 925 and your.

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Rtclsmlsuwjzgm

Franklin Federal Tax Free Income Fund

Income Tax E Calculator 2020 21 Old Vs New Budget 2020 21 Check Your Income Tax Youtube

Villas For Sale In Nh 58 Ghaziabad 22 Independent Villas In Nh 58 Ghaziabad

Income Tax Calculator Singapore Salary After Tax

Online Mortgage Lender Fast Fair Easy Wyndham Capital

The River Estate Lyme Nh

New Hampshire Income Tax Nh State Tax Calculator Community Tax

22 Properties For Rent Near Hp Petroleum Pump Yapral Hyderabad

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

3 12 154 Unemployment Tax Returns Internal Revenue Service

Property For Sale In Suchitra Hyderabad 89 Houses For Sale In Suchitra Hyderabad

Fixed Rate Or Variable Which Is Better For Your Business Ces

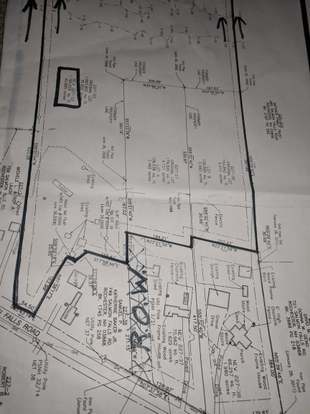

15 Evans Rd Rochester Nh 03867 Mls 4928465 Redfin